Why problems may loom for inventory marketplace if Cathie Wood’s ARK Innovation ETF fails to bounce

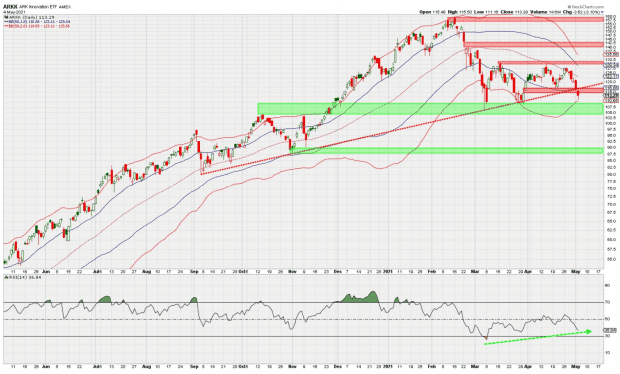

3 min readCathie Wood’s ARK Innovation trade-traded fund is considerably oversold and due for a bounce, but if it doesn’t get one the common fund challenges struggling a steeper drop that could spell some trouble for the broader industry, says just one chart watcher.

“With the large down working day yesterday, ARKK actually violated a trendline that linked some notable lows likely back to September, which isn’t ideal,” reported technological analyst Andrew Adams, in a observe for Saut Technique on Wednesday. “It now

wants to recuperate this line speedily or risk breaking down in a doable waterfall drop.” (See chart beneath)

Saut Technique

An attempted bounce on Wednesday fizzled, with the ETF

ARKK,

ending the working day down 1.5% at $111.55. Adams sees assist in the $105 to $110 location. But if that fails to hold there is not significantly in the way of even more assist right until closer to $90, building it quite crucial that the fund and other substantial-advancement places of the sector locate a bottom quickly, he claimed.

ARKK and other funds focused on previously highflying development stocks are sitting down on big gains considering the fact that the pandemic-impressed bear marketplace lows of past March, turning Wooden, founder, chief executive and main financial commitment officer of ARK Expenditure Administration LLC into just one of Wall Street’s star stock pickers.

See: The Tom Brady of asset management? Men and women enjoy to detest Cathie Wooden, but her money get success

But extra just lately, they have occur less than significant tension as investors, betting on a wide U.S. economic reopening and the launch of pent-up buyer demand this summertime, have favored more cyclically delicate sectors and worth stocks.

A sharp selloff in higher-profile tech shares despatched the Nasdaq Composite

COMP,

and the far more tech-concentrated Nasdaq-100

NDX,

down practically 2% on Tuesday, even though ARKK fell 3.1%. The damage somewhere else was more contained, with the S&P 500 index

SPX,

falling just .7% on Tuesday, although the Dow Jones Industrial Common

DJIA,

eked out a acquire.

Study: Who sparked the tech-inventory selloff? Blame the boomers

ARKK remains up nearly 103% about the last 12 months but is down 7.6% this 7 days and additional than 10% for the 12 months to day, leaving it additional than 30% below its 52-7 days substantial shy of $160 in February. Significant indexes were blended Wednesday, with the Nasdaq erasing a modest rise to finish with a decline of .4% while the Dow rose .3% to finish at a document.

Adams was cautiously optimistic about prospective customers for a bounce.

“Many of the ARK and identical money that keep high growth stocks are now trading in between just one and two standard deviations underneath their 50[-day moving averages] where buyers generally enter,” said specialized analyst Andrew Adams in a Wednesday notice for Saut Approach. “I never believe the industry needs to go down any more, so a bounce try really should come about given all the nearby aid stages.”

But if a bounce does not arise, “I assume we’ll then have to be a little little bit a lot more anxious,” Adams wrote.

ARKK came near to hitting a band two regular deviations underneath the 50-working day transferring regular on Tuesday, which suggests it is presently oversold and hitting draw back extremes, he wrote.

What are the implications for the broader current market?

“If the large-development areas get started breaking help and using the relaxation of the marketplace down with them, then perhaps the 3,980-4,000 zone in the S&P 500 will be retested following all,” Adams wrote. The S&P 500 concluded at 4,167.59 on Wednesday, 1% off a history shut of 4,211.47 set on April 29.

A test of guidance in the 3,980-4,000 area would mark a pullback of only 5% to 6%, but given the harm viewed in other areas of the market place could guide to “some huge losses” somewhere else, he stated. “I’d fairly prevent that, so for now I believe we can use yesterday’s lows as a test to see if that represented a offering climax in significantly of the sector.”

:max_bytes(150000):strip_icc()/GettyImages-2191956349-c49b5e8adc0849fbbab2adaf2b68c001.jpg)